The most effective method to work stock to bring in cash in bear market

Tip 1: Pick quality stocks. From the meaning of ROE, it tends to be known that ROE = net benefit/net resource and how much benefit created per yuan. According to the viewpoint of investors, the proficiency of utilizing reserves contributed by investors can be estimated. The higher the file, the higher the profit from venture of investors, or the lower it is. The higher the ROE is, the more proficient the utilization of assets will be. Capital seeks after interests, so more finances will pursue undertakings with exceptional yields. Subsequently, an ever increasing number of individuals will incline toward organizations with high net resource returns and purchase stocks, hence driving up the stock cost. According to an expert perspective, you can consider keeping above 15% for five successive years. In the event that you are an exceptionally utilized endeavor, the ROE information will be limited by 30%.

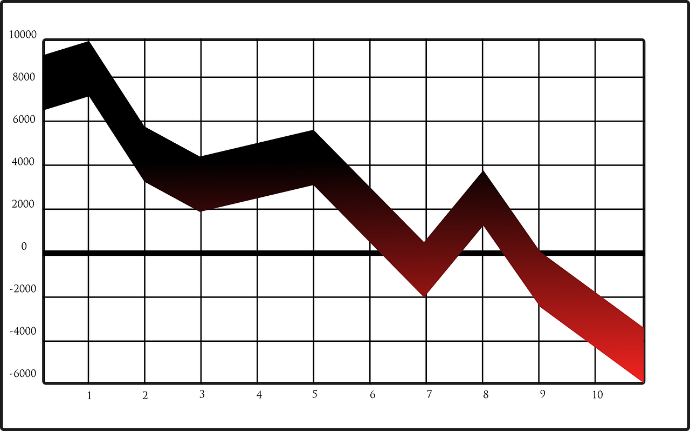

Utilizing such a basic pointer, combined with DCF, PE and PB markers, you can choose a great arrangement of stocks. In any case, regardless of whether the stock chosen in the bear market is excellent, it doesn't imply that it will conflict with the pattern, particularly toward the ever changing unpredictability of the market, we want to exploit this market qualities, to sell high and low, this is the matrix exchanging system. Stunt 2: High recurrence low pull (lattice exchanging). Network exchanging isn't new and has become famous in the forex market as a kind of shock exchanging framework. Network exchanging is the quest for market unpredictability, the greater instability, the higher the yield. Regardless of whether your hidden speculation go up, as long as you continue to move in a reach, you can in any case make a decent return. The main piece of lattice exchange is the boundary setting of framework: including network position, matrix size, framework number, and so on. The setting of upper and lower costs makes the exchanging run inside a specific cost range and maintains a strategic distance from the impact of one-sided pattern in a hidden manner. For those stocks at the lower part of the position, everybody is long haul hopeful, so without a doubt hesitant to sell, through the method of network exchanging, predominantly wanting to expand the number. This is like our previous statement. Through the matrix exchanging, you might in the bear at any point market, volatile to do the band, increment the pay. Be that as it may, lattice exchanging is truly challenging, for common financial backers, one more basic method for doing is to placed cash in. In the past talk, we discussed file reserve venture, however truth be told, for top notch stocks, you can likewise contribute. Tip No. 3: Make an effort. The pattern of individual stocks is to a great extent impacted by the general financial exchange, particularly the comparing style file. In the different variables influencing the arrival of the stock list, the most significant is the valuation, which is additionally the main key element of the entry time. According to another point of view, the ups and downs of the file are driven by market feeling temporarily. Securities exchange unpredictability doesn't mirror the actual occasion, however the response to the occasion, so market opinion is the subsequent key component.

Conclusion: There are such significant stunts in a bear market, the first is to hold top notch stocks as a base position (the supposed base position is a drawn out stock portfolio, or at least, the essential request. The second is to search for chances to sell high and low, and the third is to make record wagers.

(Writer:Tommy)